Operating Base

What does it mean to say a company has a good operating base?

The concept, though not something that is used often in financial and business worlds, is extremely important.

The idea stems from a holistic qualitative and quantitative analysis of what sets companies up for success. It is not that a company with a solid operating base will necessarily outperform, but it gives very strong confidence that the downside risk is protected. It is like the foundations of a house.

Below are a few examples of factors that are important in determining the operating base. Individual portfolio managers emphasize different factors depending on their own preference and experience. In the end the objective is to narrow down to the key issues and answer the question – does this company have a good operating base? An affirmative answer is important and we don’t invest in companies where this is not the case.

Product positioning

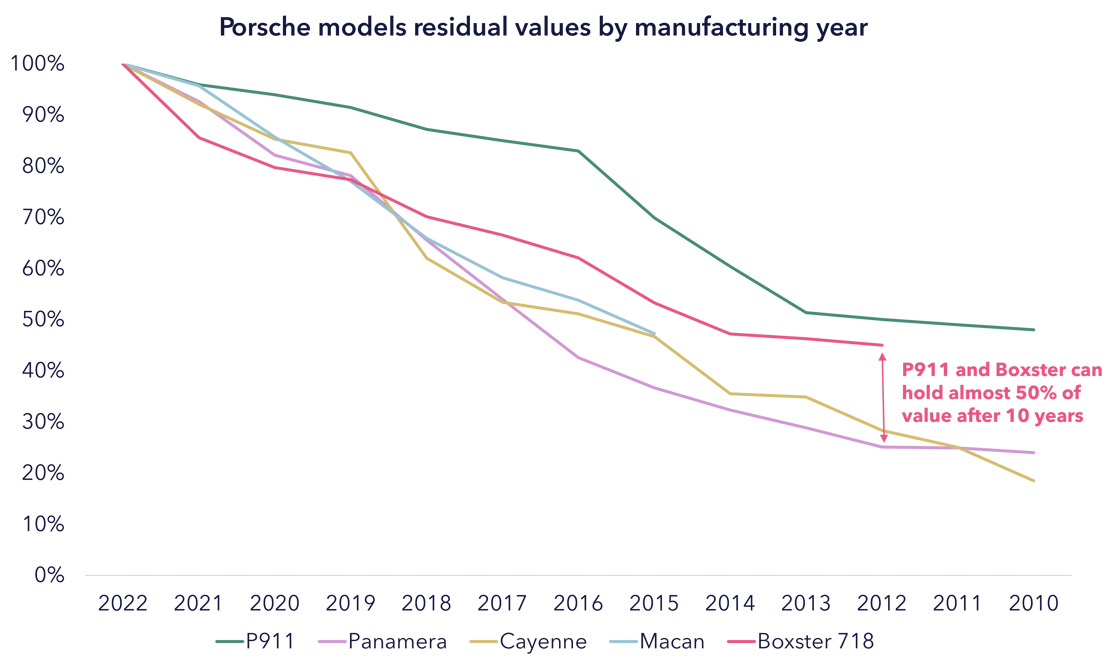

Understanding the nature of a product sold by the company allows us to build an accurate picture of many facets of the business. Take Porsche (P911 GY). By digging deeper into the product set it becomes clear there is a marked difference between the products it sells. The best visual representation of this is residual values by model over time.

Doing this shows that Porsche is in fact two businesses – the 911 / Boxter, which are true luxury cars holding almost 50% of their value after 10 years, and all the other models, that depreciate more like mass brand vehicles.

R&D

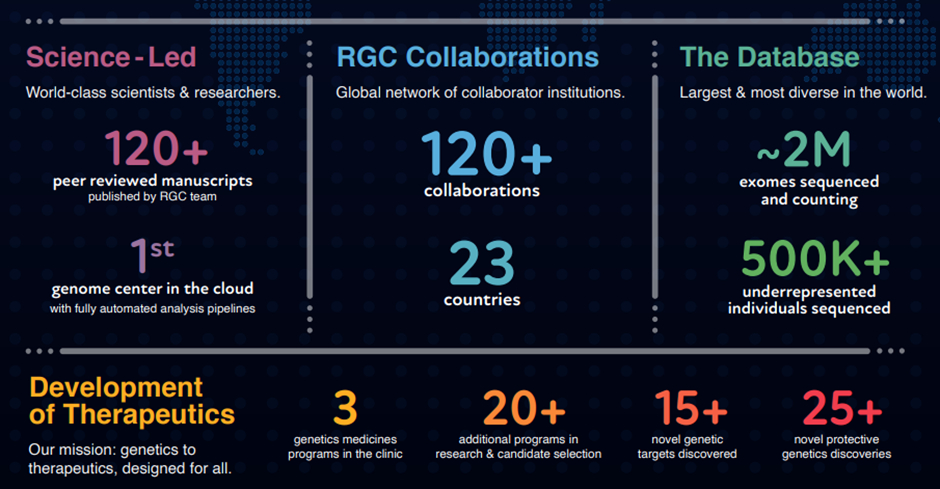

Research and development is the lifeblood of many companies and foundation of their future value. This is especially true in life sciences, where existing products need to be replaced. For example, Regeneron, under the leadership of Leonard Schleifer and George Yancopoulos, has built an unrivaled capability to:

1. Draw insights from human genetics via the Regeneron Genetics Centre, home to the largest and most diverse genomic database in the world. This creates a capability to find new drug targets.

2. Engineer best-in-class antibodies through their comprehensive VelociSuite technology platform.

3. Expansion of this platform to other exciting drug classes. Together these factors contribute to the company’s long-term competitive advantage in biotechnology.

Management and incentives

The success of many businesses relies on the track record, experience and incentives of their management teams. We spend a lot of time trawling through proxy statements, manager biographies, shareholdings and background checks to build a full picture of the executive and non-executive suite. Often we pass on investments where we feel management aren’t set up for success. For example, we prefer US-based financial exchanges to European ones. The latter management team’s incentives are not aligned with shareholders leading to disjointed strategy and penchant for expensive M&A, as we have seen with Deutsche Boerse.

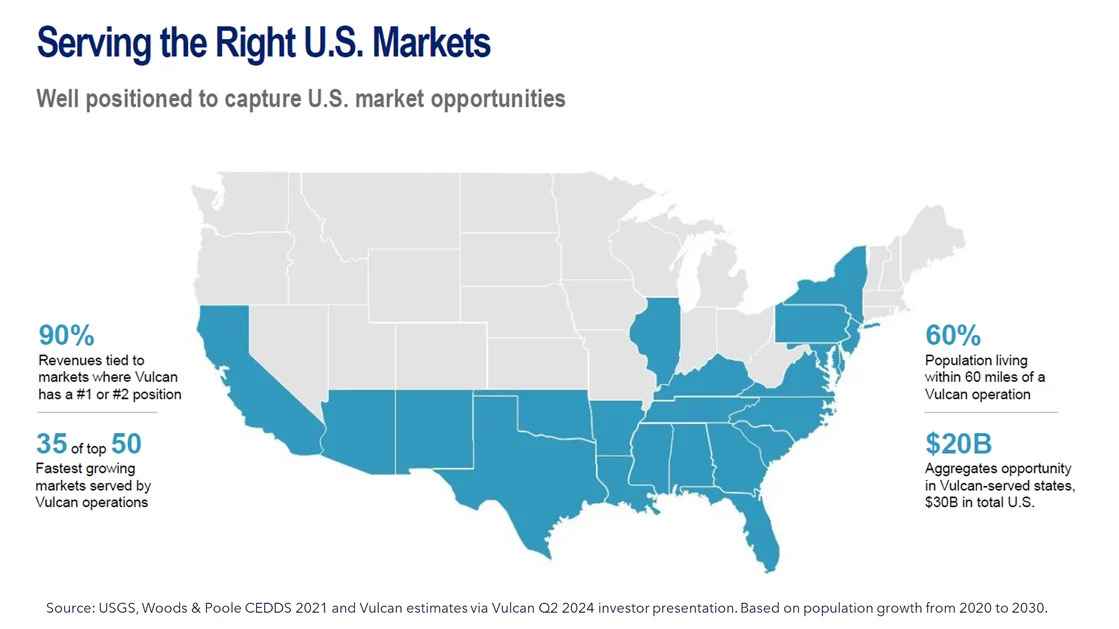

Location location location

Sometimes operating base can be as simple as being in the right place. For example, Vulcan materials which is in the business of mining and crushing rock (called aggregates) used in construction. Aggregates have a very high weight to value ratio making them uneconomic to transport for anything more than 100km. This means where quarries are located matters. Vulcan is positioned to serve the 20 of the top 25 fastest growing markets, which gives them an enviable position and a strong geographic operating base.

Business model

This is a holistic term to understand how, at scale, a firm make money. Often weak business models mean the business is not set up to survive, something that can happen at every stage of its development. For example, we chose to pass on investing in Fortinet, that produces physical firewalls, as its business model and technology are not equipped to help customers transition to a cloud-based world. In the latter, firewalls need to move with the user, be scalable and easy to maintain. Cloud native firewall firms, like Zscaler, are potentially better positioned and are subscription-based saving IT departments money in the long run.

Conclusion

In summary, we only invest in firms where our fundamental analysis meets our first pillar – that they possess solid operating basis based on a collection of different factors.