Generating Investment Ideas

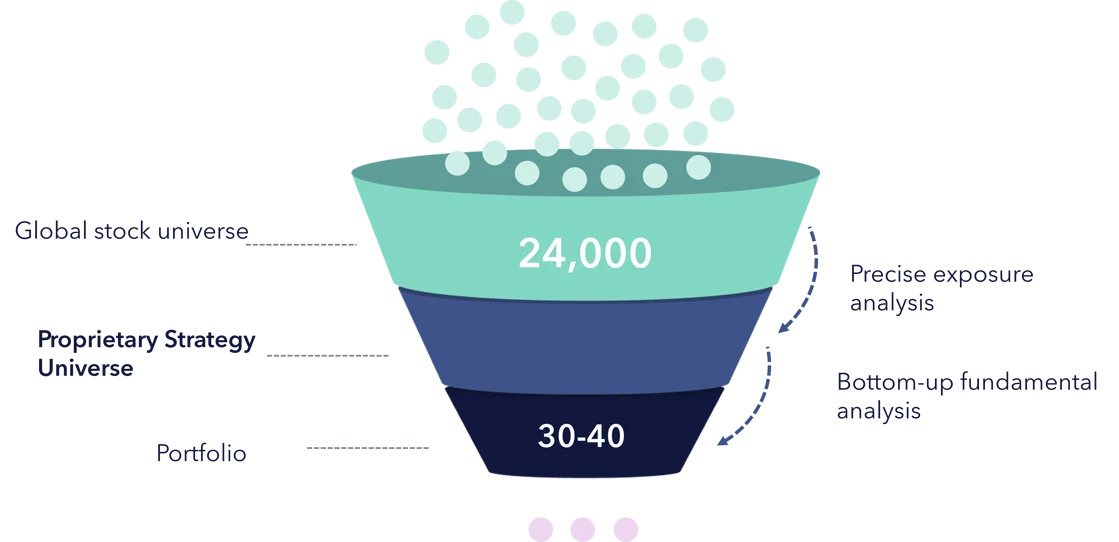

There are 24,000 listed equities in the world that meet the minimum inclusion criteria for our ETFs1. So how do we go from that to a final portfolio? How do we generate investment ideas?

Step 1 – Proprietary universe – define the pool to fish in

The first step to generate a good investment idea is defining the pool of investment opportunities to fish in. This step is really about excluding companies that are not precise expressions of our strategies. Luxury is a good example: we believe the sector is often muddied with companies that are simply mass consumer. We estimate these account for almost 25% of S&P Global Luxury Index. This type of exclusion work takes effort and careful analysis to determine what is a luxury company – not something that can be easily screened for. Qualitative analysis of this sort can build an edge early on and sustain it through careful maintenance.

Defining a pool also upgrades the quality of our eventual portfolio ideas. For example, in our strategic TOLL fund we seek to select dominant firms in concentrated industries. Remarkably, a simple database of market shares does not exist. This means we must build from the ground up, using company disclosures, sell-side industry primers and other research a universe of monopolistic industries. By focusing on these firms, we naturally zero in on firms with strong financials such as return on capital and pricing power.

Step 2 – Narrowing down the research set

Once we have built dynamic universes for each strategy, it is often helpful to narrow down further to a research set. Here we employ quantitative screening tools. Examples include:

- Returns – screening for firms with high and rising returns on invested capital.

- Balance sheets – excluding firms that exceed Net Debt to EBITDA limits.

- Growth – look for firms with a history of consistent organic growth.

- Valuation – find firms that trade on multiples that are more than a standard deviation discount to historic averages.

Step 3 – coming up with investment ideas

Although the above help narrow global equities to a manageable research set, it is important at any stage in the cycle to leave idea generation open to serendipity. Logical deduction, though powerful, isn’t enough.

In 1959 the science fiction author Isaac Asimov was invited to participate in a project to develop the most creative approach to ballistic missile defense. His time on the project was brief but it led to him to pen one of the best essays on creativity and idea generation.

This essay has formed the basis of how we at Grijalva Investments approach the serendipitous part of idea generation using his main principles:

1. Daring to make cross-connections – ideas are born not just out of facts and knowledge but the ability and, even more importantly, daring to make cross-connections. Good ideas often seem unreasonable at first.

2. Working as a team – getting together helps because “no two people exactly duplicate each other’s mental stores of items”. This exchange of facts and combinations of facts means fruitful “cerebration” sessions in our investment team.

3. A helpful guide – orchestrating idea generation is akin to playing the role of a psychoanalyst asking the right questions. This role, played by our CIO, helps portfolio managers reflect and elicit new understanding and ideas.

Conclusion

Investment idea generation starts with a good strategic universe, narrows down to a useful research set and leaves the rest to creativity.